Check out the full copy of “A Practical Synopsis of the Intelligent Investor Series“

The Intelligent Investor Series- Chapter 5 : The Defensive Investor and Common Stocks

Welcome back to the Intelligent Investor series. In chapter five of The Intelligent Investor we take a closer look at the administration of common stocks in the defensive investor’s portfolio. The chapter describes the benefits of common stocks; how a defensive investor should configure his portfolio. Here’s the list of preceding posts if you’d like to get caught up:

Graham starts by making a case as to why the defensive investor needs to continue focus on common stocks compared to bonds. He reminds the reader that stocks typically offer good protection against inflation compared to bonds and average a higher yield (in dividends) than bonds. I love how he focuses not on why you should buy stocks, but how you can lose these advantages if you pay too high a price for the issues of stock in the first place.

Taking dividends into consideration is equally as important. Zweig comments:

“A stock’s yield is the ratio of its cash dividend to the price of one share of common stock. If a company pays a $2 annual dividend when its stock price is $100 per share, its yield is 2%. But if the stock price doubles while the dividend stays constant, the dividend yield will drop to 1%.” — at the time he wrote this (2003), stock yields had never been higher than bond yield for four decades prior.

Defensive Parameters

In light of his affinity for stock issues, Graham offers the following parameters a defensive investor should follow when making stock acquisitions.

- Adequately diversify. Roughly 10 to 30 different issues

- Each company should be “ large, prominent, and conservatively financed”. “ An industrial company’s finances are not conservative unless the common stock (at book value) represents at least half of the total capitalization, including all bank debt” , “to be considered large a company should have a total stock value (or “market capitalization” of at least $10 billion (2003)”, the suggestion on company prominence is that the company is ranked among the first quarter or first third in size within its industry group”

- Company should have a long record of continuous dividend payments. Between 20 to 30 years of payments

- A suggested limit of a price not over 25 times average earnings, and not more than 20 times those of the last twelve-month period. The goal here being to eliminate “growth stocks” from the defensive investor’s portfolio.

Working into the portfolio itself, the defensive investor needs to ensure that his agents adhere strictly to the four rules and also have an understanding of the defensive investor’s goals to make few changes to his holdings or policies over the long term. Combined with a dollar-cost average buying plan of market-tracking index funds and the defensive investor’s portfolio has autopilot features baked right in. Graham does a good job noting that what matters isn’t your age but your required cashflows and ability to commit time to your investment education and administration of your funds.

On Risk

Graham later lays out an important perspective on the concept of risk. He mentions that the words “risk” and “safety” are applied to securities in two different senses which causes confusion. Graham says, a bond is considered unsafe when it defaults its interest or principal payments, just as a stock is considered unsafe if it misses a dividend payment the investor intended to capitalize on. Lastly, there is risk if there is a fair possibility that the holder may have to sell at a time when the price is well below the cost. However, he believes these types of risk are inherent in all other types of investments except U.S. savings bonds.

Graham believes the concept of risk needs to be applied solely to a loss of value which either is realized through actual sale, or is caused by a significant deterioration of the company’s position. More often, the cause may also be attributed to the overpayment for a security than its intrinsic worth.

Zweig’s noteworthy comments focus on concepts of what to buy, and how to buy it. He makes strong mention of “buying what you know”. That is, focusing your acquisitions in markets you’re familiar with, applying the four principles, and then analyzing their financial statements and business value. “Buying what your know” gives you the ability to buy issues with a lower educational overhead than, say, an industry that appears lucrative but would require double the time spent to research and determine the all-stars. He points out, however, that familiarity can breed complacency. Clinging to the singular hope that because you understand an industry means you needn’t investigate the business value is no acceptable way for a defensive investor to act. He cautions “ the more familiar a stock is, the more likely it is to turn a defensive investor into a lazy one who thinks there’s no need to do any homework.”

Lastly Zweig’s remarks about the benefits of dollar-cost averaging sheds light on one effective way of removing emotion from your investment strategies. With a DCA strategy and market tracking index funds, you’re able to answer “don’t know, don’t care” to anyone asking you to predict or speculate. Over time your gains should stack up and allow you to be relatively passive with your defensive investment strategies.

As I continue to work through the chapters, my goal is to post on each chapter’s central tenants. If you find something out of place, or care to strike up a discussion feel free to comment or find me on twitter @DavidCappelucci.

Recommend the article if you found value in it and would like to follow along.

-David

The Intelligent Investor series (Chapter 4)

Welcome back to the Intelligent Investor series. In chapter four of The Intelligent Investor we take a closer look at “General Portfolio Policy” for the defensive investor. Much of the chapter’s content focuses on different investment vehicle options and how the defensive investor may best leverage those in a manner suitable for their risk profile. Here’s the list of preceding posts if you’d like to get caught up:

Graham begins the chapter re-focusing the reader on the difference between the Defensive Investor and the Aggressive Investor. Primarily mentioning that while both investors have a goal of preserving their principle, the defensive investor chooses to handle their portfolio in a hands off manner. The key here is:

The rate of return sought should be dependent on the amount of intelligent effort the investor is willing and able to bring to bear on his task. The minimum return goes to the passive investor, who wants both safety and freedom from concern. The maximum return would be realized by the alert and enterprising investor who exercises maximum intelligence and skill.

Graham remarks that the common 25/75 splits of bond/stock allocation that is typically offered to a defensive investor as a sound plan may no longer hold with the markets at their current highs (1972). As I’ve remarked in previous writings, I think he would say the same for our current 2016 price levels. Given the pricing situation at the time, Graham instead suggests that the truly defensive investor should seek a 50/50 split between bond and equity holdings. Looking at other common allocation philosophies I think it’s challenging for anyone , at any time, to truly be satisfied with their decision of allocation. For example, right now it wouldn’t make a ton of sense to have a heavy allocation in bond markets given the low interest rates, but if things in the equity markets went south, a portfolio return could quickly become sour causing the investor the wish they had been positioned differently. The point is, no approach is guaranteed, but the emphasis is on some strategy that continues to extract emotion from your investments. In this case, Graham is comfortable with a 50/50 allocation for the defensive investor, even noting that while the returns may be only one sided, in the event of a market shift, the defensive investor is positioned to continue with an upswing on the opposite side of the market.

The investor must always account for their risk profile, market trends, and information they’ve learned to help facilitate their allocation decisions. Once that allocation decision is set, the time comes to choosing the right security in each category.

Bonds

As one begins to search for different bonds, the first question Graham focuses the investor on is the issue of taxable or tax-free bonds. Secondly, the issue of the length of maturity of each bond : shorter- or longer-term maturities? The answer to both questions above come down to arithmetic with a focus on the investor’s tax bracket. Speaking generally he mentions that most individual investors would do better after taxes with good municipal (tax-free) bonds than they would with good taxable corporate issues.

As far as handling the question of length of maturity, he indicates that the investor needs to determine whether he wants to safeguard against a decline in the price of the bonds at the cost of :

- A lower annual yield

- The loss of the possibility of an appreciable gain in principal value.

He mentions we’ll get to some of these questions further in the book at Chapter 8.

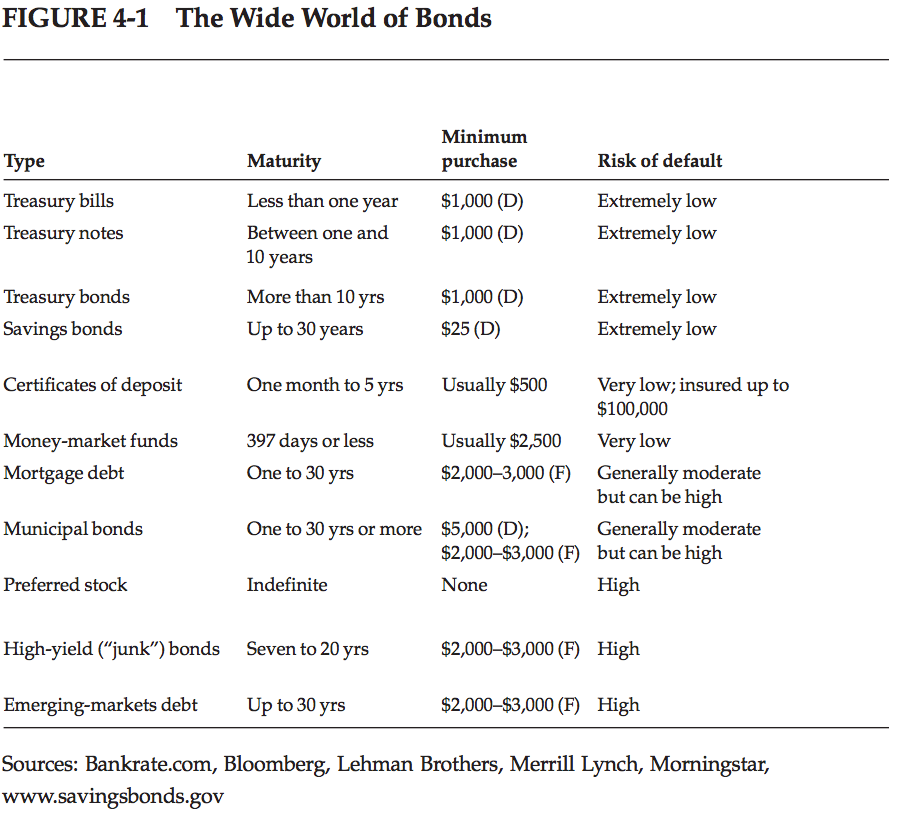

Working through some of these questions gives the investor enough answers to determine what type of bond he’d like to purchase. Graham goes through each type in great detail of which I’ve summarized below :

- U.S. Savings Bonds (note: Graham mentions Series E and H bonds, as of 2004 these issues are no longer available) — income is taxed Federally but not at a State or Local level. In Graham’s view , while the rates will be lower, the strong backing of the U.S. Government as well as the tax advantages of these bonds make these a nice option for someone interested in safe bond issues.

- Other U.S. Bonds — Income is taxed Federally but not at the State or Local level. These bonds are going to consist of issues from the U.S. Government that are considered and created typically under a particular department of the Government for a particular purpose. The example Graham gives is where U.S. backed bonds were issues by the Secretary of Transportation. Thus, while the issue isn’t exactly a U.S. savings bond, it’s still backed by the full strength of the U.S. Government.

- State and Municipal Bonds — These are free from Federal income tax and are usually free from State income tax as well but may charge local income tax. In this case, while usually safe, Graham makes mention that not all tax-free bonds are strongly enough protected to justify their purchase by the defensive investor. Sticking only to AAA rated bonds in this category is recommended.

- Corporate Bonds — Subject to both Federal and State income tax. These typically offer the highest yield but present the most risk as they are not backed by any governmental entity. As a positive note though, the company is responsible to the bond holder before the stock holder, so if there was a default, your bond holding in Company A would get paid before any equity holdings.

- Higher-Yielding Bond Investments — often associated with a substantial amount of risk. These “junk” bonds can be bought at a low price with a high-upside but an equally high risk of default. Zweig makes mention of the investor’s ability to leverage “junk bond funds” if they did want to get into this space but help limit the risk.

Graham makes a final comment reiterating how the intelligent investor must always consider taxes:

Those in high income-tax brackets can undoubtedly obtain a better net yield from good tax-free issues than from taxable ones

Stocks

Having covered quite a few dimensions of common stocks in previous chapters Graham takes an opportunity to speak on Nonconvertible Preferred Stocks. He focuses on making his point that: “Preferred Stocks should only be bought on a bargain basis or not at all”. His rational being that the preferred shareholder becomes dependent on the ability and desire of the company to pay dividends on its common stock. The company only pays the preferred shareholder dividends if, and only if, it pays dividends on its common stock.

Thus the preferred holder lacks both the legal claim of a bondholder (creditor) and the profit possibilities of a common shareholder (partner)

We then transition quickly into Zweig’s commentary on Chapter 4 which I think is some of his best commentary so far. He further undermines the concept that your asset allocation is age dependent by offering examples of how your age may not accurately depict your current financial situation or goals. Again we see an emphasis of understanding who YOU are, what YOUR risk profile is and your financial aspirations as they fit into the current and perceived future markets. He also makes mention of something Graham does not. Cash. Making note that any asset allocation can be handled by any investor, but that all investors should keep a cash reserve, or equivalent , just-in-case. This aids in the investors perception of their solvency and can help beat down any emotional bias that may come into play.

Further expounding on concepts of keeping a reserve, Zweig comments that Graham suggests that any investor should try and keep a minimum of 25% bonds at all time. The logic here being that even in a major stock market downturn, the 25% bond allocation should be able to offer another emotional cushion to rest on to keep the intelligent investor from liquidating his stocks at low prices. Basically, the 25% bond allocation might not always be a winner , but when the market drops, it’s a great anchor to keep the investor’s spirits high enough to not have an all-out emotional “firesale” of their equity holdings.

Zweig also comments on understanding your income investment goals from the perspective of tax advantages and time frames. He mentions ensuring any of your bond holdings outside of tax advantaged accounts should be tax-free bonds since it’s unlikely you’re in the lowest tax bracket which means you’ll be taxed on any income coming from any taxable bonds. He adds advice that most investors should focus on intermediate bond maturities as it will help to remove the investor from speculating what way the interest rates of the markets will go.

He goes a bit deeper into bond diversification and mentions that while it’s possible to diversify your bond holdings, it’s typically more advantageous to leverage bond funds, instead of outright bond holdings. This is because these funds typically offer low fees, help you diversify without having to own $10,000 in each bond type and you can often reinvest your monthly income without paying a commission.

After turning his attention back to stocks, Zweig really fires up on Preferred stock. Not only does he think those types of investments offer a “worst-of-both-worlds” investment, he goes further to note that the way a company is using these preferred shares has bearing on whether or not you should even put your money in the company in the first place:

If this company is healthy enough to deserve my investment, why is it paying a fat dividend on its preferred stock instead of issuing bonds and getting a tax break?

A fantastic chart is given to highlight the difference in bond types:

Finally, he finishes as Graham would; by focusing on common stock and how the investor should approach those issues (especially in light of current interest rates) :

No intelligent investor, no matter how starved for yield, would ever buy a stock for its dividend income alone; the company and its businesses must be solid, and its stock price must be reasonable.

As I continue to work through the chapters, my goal is to post on each chapter’s central tenants. If you find something out of place, or care to strike up a discussion feel free to comment or find me on twitter @DavidCappelucci.

Recommend the article if you found value in it and would like to follow along.

-David

The Intelligent Investor series (Chapter 3)

Welcome back to the Intelligent Investor series. This chapter is all about letting the Intelligent Investor review prior market data in an attempt to learn why the market acted the way it did, and determine how it may act in the future. The goal is to use this as yet another datapoint when making a decision as to whether or not the market is trending at a level that would warrant positive results. Here’s the list of preceding posts if you’d like to get caught up:

Before we really get into the meat of this, I think it’s important to reiterate that Graham and Zweig both focus on leveraging the past data of the market not to try and predict what will happen, but to help give context to any potential current market analysis.

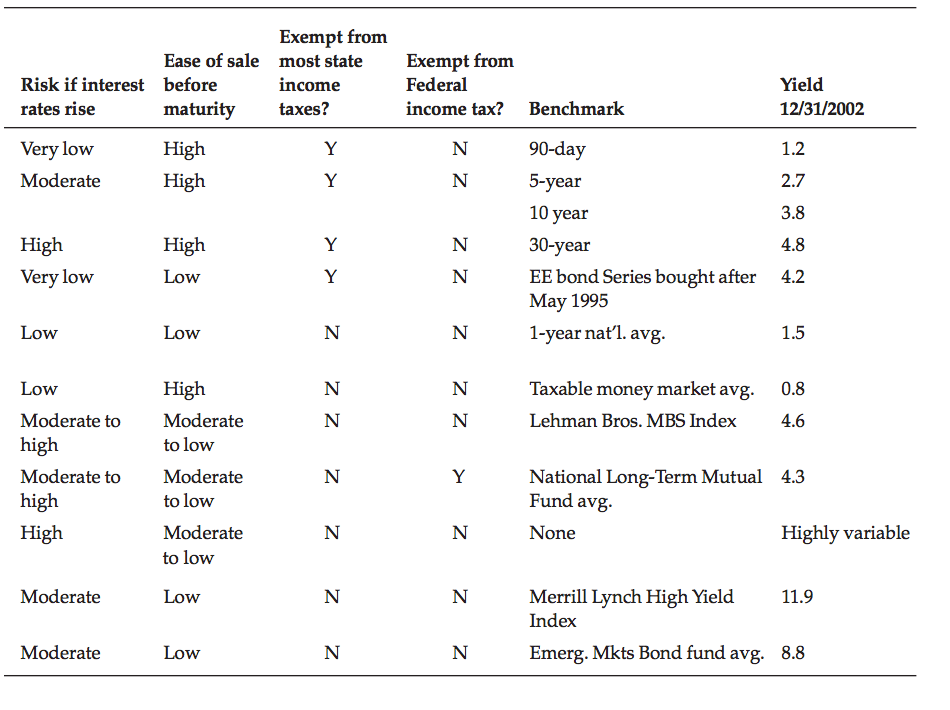

Graham begins his lesson by speaking directly about the business cycle. Noting without bias that the market has represented itself at both very high (dangerous) and very low (more favorable) levels to the value investor. By taking a look at 10 year averages we begin to get a better feel for how the business cycle has influenced, or been influenced by the thoughts and feelings of investors and speculators alike. He notes that the Intelligent Investor would do well to pay attention to how the price, earnings and dividends of issues has changed with the business cycle but that the changes may not even show correlation to the business cycle, much less causation. What past data can suggests is, typically, mega-rises have tended to disappoint,while major crashes have usually evened out at a higher level than the “experts” had forecasted.

“One extreme to another carried a strong warning of trouble ahead”

After reviewing the nearly 100 years of market data he had at the time, Graham gives the 1964 Intelligent Investor some advice for the future:

No borrowing to buy or hold securities

No Increases in the promotion of funds held in common stocks

A reduction in common-stock holdings where needed to bring it down to a maximum of 50 per cent of the total portfolio. The capital-gains tax must be paid with as good grace as possible, and the proceeds invested in first-quality bonds or held as a savings deposit

Taking a look at 1964 compared to our 2016 current situation, we can draw on the following comparison between then and now.

Graham typically argues that the price of the S&P 500 and DJIA is too high and that investors need to care for their capital by comprising at least half their portfolios with safer alternatives to stocks. Comparing this to today, with both indexes at their high, I feel that he’d recommend the same advice. This time however, the bond rates aren’t the cushy 3–4% they were in ’64. The safe haven of a bond now comes at the price of 4% , versus the 1–2% of the past. It seems we get put in a bit of a precarious situation given that the price of the stock market doesn’t seem based in reality and bond offerings are less than dismal.

Some advice Graham may continue to reiterate is to develop a consistent and controlled common stock policy. Discouraging the “beat the market / pick the winners” mentality. Recall defining the investor and incorporating principles of investing for value.

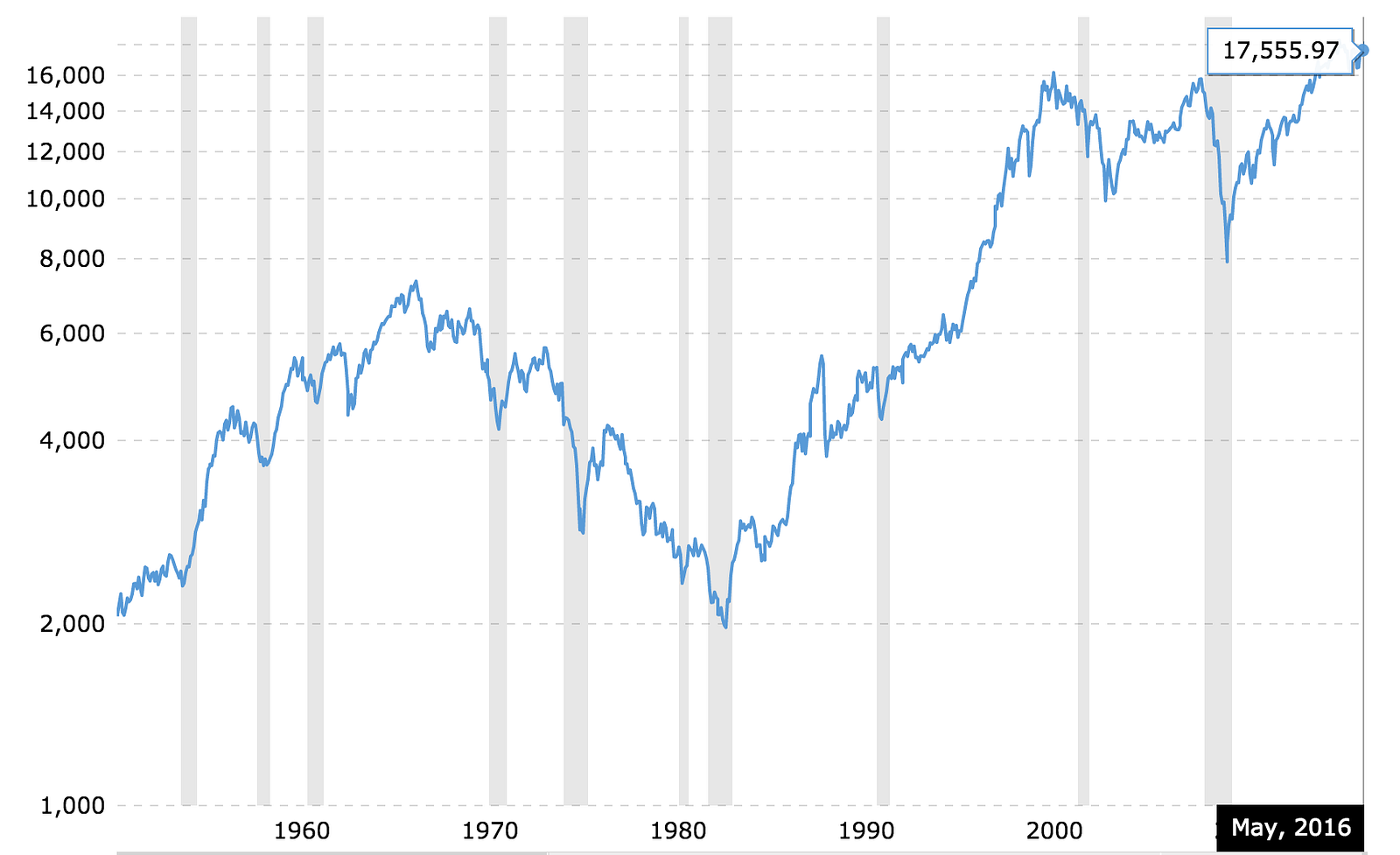

Graham turns his attention to reflecting on the the price of stock offerings versus their earnings and dividend yields. Using the table below he explains how we see the multiples of EPS and dividend growth failing to match that of an issue’s price growth.

In this case, you’re paying more for less, which highlights that the price you pay is not equal to the value of the issue.

Zweig’s commentary again offers insight and strengthens Graham’s arguments.

One of his most insightful pieces comes on page 83:

“When every investor comes to believe that stocks are guaranteed to make money in the long run, won’t the market end up being wildly overpriced? And once that happens, how can future returns possibly be high?”

Zweig also returns the investor to basic value principles by stating that a cheaper issue does not equal 7% stock returns. You still need to be selective about the companies that you buy, which will be the focus of the remaining chapters. Zweig builds on Graham’s advice from before by offering what an issue’s future growth is dependent on the following three factors:

Real Growth (the rise of companies’ earnings and dividends)

Inflationary Growth (the general rise of prices throughout the economy) ** For an analysis of Inflationary Growth check out Chapter 2**

Speculative Growth — or decline (any increase or decrease in the investing public’s appetite for stocks)

The Chapter and commentary did a good job of describing valuable ways of evaluating data from the market’s past. It also declared that stocks were still preferred to bonds overall. Finally we are oriented to develop our investment techniques as investors , not speculators as we are reminded:

The only thing you can be confident about while forecasting future stock returns is that you will probably turn out to be wrong

As I continue to work through the chapters, my goal is to post on each chapter’s central tenants. If you find something out of place, or care to strike up a discussion feel free to comment or find me on twitter @DavidCappelucci.

Recommend the article if you found value in it and would like to follow along.

-David

The Intelligent Investor series (Chapter 2)

Welcome back to the Intelligent Investor series. This post reveals Graham’s stance on inflation and what the Intelligent Investor can do to maintain consistent results that protect their buying power. The preceding posts on the Introduction and Chapter 1 can be found here.

The chapter begins by explaining how inflation needs to be in your considerations of not just your end investment successes , but in choosing an investment vehicle that performs best in a given inflationary circumstance. He makes note that, once again, the investor is able to make use of past data to position his assets in a way that will compliment inflation.

Graham focuses immediately on the concepts that inflation will be felt most with portfolios that focus on fixed dollar income rather than ones that vary with the market. Essentially stating that high-quality common stocks have typically been able to better accommodate desired returns during periods of high-inflation. He’s comparing this to bond yields that would typically be eaten up by inflation. He admits though that stocks may perform better than bonds , but there will always be two influences on those equity markets:

The investment results over the long-term

What is likely to happen to the investor financially or psychologically as the investor’s demeanor does not span his life, rather, around 1 year investment goals

Graham’s point being two-fold here:

We can assume that common stocks will outperform bonds, but we cannot be sure of it

The investor should then position his holdings to be adjusted for some level of uncertainty that stocks would underperform bonds rather than an all-stock strategy.

Eventually, Graham goes on further to describe that the markets have also shown that investing in “things” as a hedge against inflation has not turned out to be a prosperous venture in the past. He suggests: rather than buying into physical things , the investor is again speculating on the future price and value of the object. Zweig notes here that an investor under the age of 65 would actually do well to have about 2% of their financial assets in a fundexposed to precious-metals, rather than buying the metals outright. The point he remarks here is that the 2% holdings is too small to affect your returns if it does poorly, but can help offset losses due to inflation.

Ultimately, Graham agues that :

The more the investor depends on his portfolio and the income therefrom, the more necessary it is for him to guard against the unexpected and the disconcerting in this part of his life.

Zweig’s commentary on this chapter was concise and relevant.

He reiterates the importance for the investor to understand his investing success in terms of how much you keep after inflation. One should recognize how this concept relates so centrally to Graham’s philosophy of protecting your principle. I got interested in checking out inflation against my after-tax results and was surprised at how neatly the data is presented on current and past inflation here, but I so rarely hear other investors talking about their gains compared to rates of inflation.

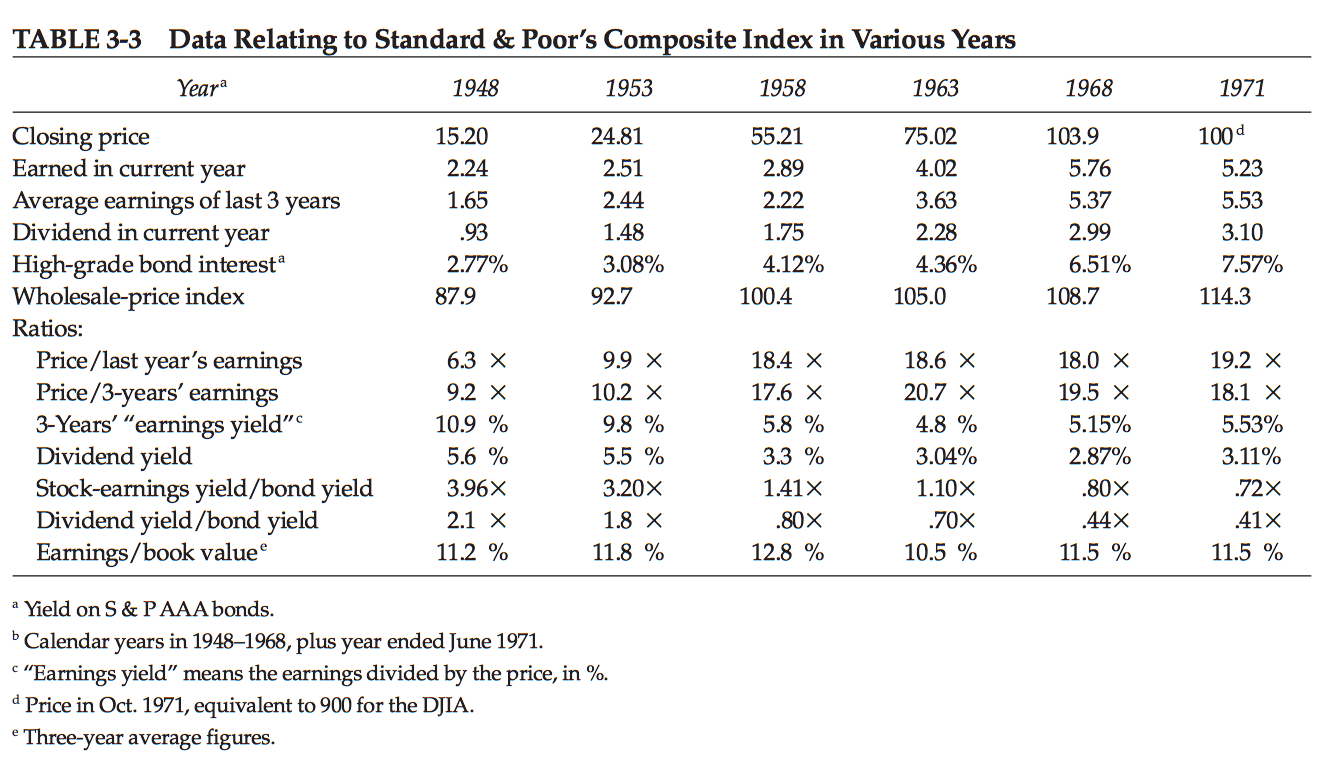

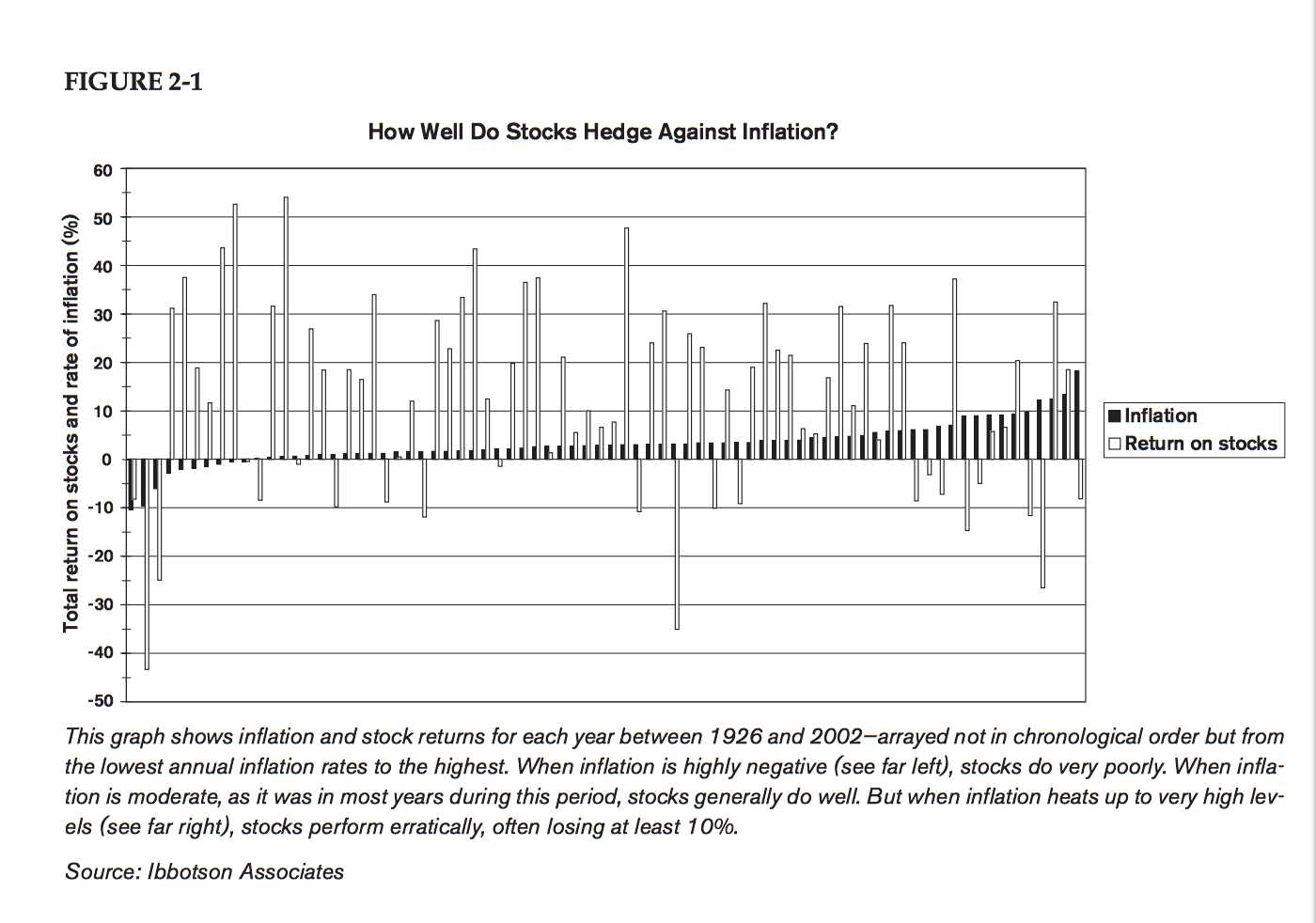

One of Zweig’s greatest contributions was the graph that shows how stocks performed based on various inflation rates:

Zweig also goes on to mention how the investor now can help hedge against inflation as he can invest in REITs (Real Estate Investment Trusts)and TIPs (Treasury Inflation-Protected Securities).

The Intelligent Investor, now armed with a knowledge of inflation’s affects on equity and debt markets can make a wiser asset-allocation decision in the context of his current financial goals and subsequent acceptable risk levels.

As I continue to work through the chapters, my goal is to post on each chapter’s central tenants. If you find something out of place, or care to strike up a discussion feel free to comment or find me on twitter@DavidCappelucci

Recommend the article if you found value in it and would like to follow along.

-David

The Intelligent Investor series (Intro & Chapter 1)

My goal over the next few months is to write a blog style reporting of the “lessons learned” coming out of the book“The Intelligent Investor” by Benjamin Graham.

This first post is going to cover an introduction to the goals and rationale for creating this content and then will lead into a review of the Intro and Chapter One of the text itself.

I had picked up the book two or so years ago, and had started it out but only made it in about 3 chapters in before moving onto something else. This time, I set out to complete the reading and make public note of its lessons.

A brief overview of the introduction is described as focused on dismissing the “hot” investment techniques that live on Wall Street , and then to re-iterate the importance of buying securities for their underlying business value, versus an emphasis on the stock price itself. More can be found about the author : Benjamin Graham here.

Intro

The introduction goes through and lines up the difference between a defensive investor, and an aggressive investor. Graham then further explains that regardless of the type of investor, each needs to understand that their RRR shouldn’t be terribly higher than the market itself. These so-called “average returns” for the defensive investor, and “slightly-above-average returns” (+2–3%) for the aggressive investor be should always be satisfied by constant, repeatable wins , instead of big win/loss swings. As a side, this is much like the “repeatable golf” we all seek each time we swing the golf club.

Consistent growth over one-time wins

Graham begins to allude to his methods associated with value investing and primarily covers truths that affect both types of investors. He mentions :

“to invest in securities one should be forearmed with an adequate knowledge of how the various types of bonds and stocks have actually behaved under varying conditions”

His main points centering around understanding that there is no dependable way to select only the most promising companies in the most promising industries. He gives further insight into industry speculation by noting that:

“obvious prospects for physical growth in a business do not translate into obvious profits for investors”

Lastly, Graham focuses the reader’s attention to buying into the value of a company, rather than just the price of its stock. Making note that :

“the habit of relating what is paid to what is being offered is an invaluable trait in investment”

then suggests that the reader focus only on buying issues selling not far above their tangible asset value.

Chapter 1

Graham begins chapter one with an focus on describing speculation versus investing. Outlining importantly that:

“an investment operation is one which , upon thorough analysis promises safety of principal and an adequate return. Operations not meeting these requirements are speculative”

Further expounding on speculation, he makes note that from 1949–1969, theprice of the DJIA increased 5-fold , while the actual earnings and dividends only doubled. The emphasis being that the prices were influenced by speculator attitude, rather than underlying corporate value.

It’s also here where he references the Gordon Equation which is summarized in the link below:

Due to some of the “speculation” that seems to go into predicting the dividend growth rate, I found it a bit ironic that this equation was referenced by Graham, however I recognize that using this model in tandem with other analysis is still better than a WAG or strictly speculating on the rise or fall of price.

Graham finally dives into what the Aggressive Investor needs to do to continually find better than average results. He needs to focus on investment practices that are:

- Inherently sound and promising

- Not popular on Wall Street

He then lays our that for investing to be anything other than speculating , you need three consistent elements:

- You must thoroughly analyze a company and the soundness of its underlying business. (thorough analysis: the study of facts in light of established standards of safety and value)

- You must deliberately protect yourself against serious losses

- You must aspire to “adequate”, not extraordinary performance

Graham is full of one line quotes that seem to capture his goals of orienting the reader with the difference between speculating and investing. His quote:

“invest only if you would be comfortable owning a stock even if you had no way of knowing its daily share price”

contrasts the fast-trading we tend to see in the modern information era of investing where stocks are bought and sold quickly. He finishes by focusing the rationale on two concepts that can be taken to heart.

- The intelligent investor has no interest in being temporarily right

- Stocks do well or poorly in the future because the businesses behind them do well or poorly — nothing more, and nothing less.

As I continue to work through the chapters, my goal is to post on each chapter’s central tenants. If you find something out of place, or care to strike up a discussion feel free to comment or find me on twitter@DavidCappelucci

Recommend the article if you found value in it and would like to follow along.

-David

How to bank hundreds of dollars more each month – Yahoo Finance

How to bank hundreds of dollars more each month – Yahoo Finance.

The article pairs well with my piece on budgeting.

Living well within your means can help you sock away loads of cash that you can turn into your emergency fund, loan repayment and eventually your nest egg.

Never forget the power of compound interest, also remembering that you need some capital to get that rolling.

#savenow

http://finance.yahoo.com/video/bank-hundreds-dollars-more-month-165852170.html?format=embed

Why The Fuck Aren’t You Budgeting?

In the world of personal finance having controls over your cash outflows is the first step to being in control of your cash inflows.

Many folks get wrapped up in investing, seeking higher paying jobs or trying to control income by selling loads of their extraneous shit. If you want to get on the road to financial independence (those that have read Your Money or Your Life identify as FIers) budgeting is a must.

Before we get started, I must add a quick note about those who don’t agree with budgeting. These people tend to say things like “I look at the aggregate”, “I’m in control of my own spending, and it’s all in my head” or something stupid like “my revolving credit utilization is never more than 50%”… Ever heard of being “Pound wise and penny foolish”? I’ll show you how to manage your cents efficiently and be surgeon-precise with where you spend your hard-earned greenbacks.

There are plenty of tools and strategies to budgeting, some you’ll like, and others that won’t fit your lifestyle and dreams. Before we get too far into the fancy spreadsheets, reports and mobile apps, you must change your mindset about budgeting and spending.

How I came to budget

My first job was at a home-grown rental shop called Chardon Rental, part of CCM Rental. My then boss, a man who’s had influence on many aspects of my life, was asking me about some “gazingus pin” I was about to buy. He looked at me and asked how much it would cost, I told him some dollar amount, to which he responded “How many plate-tampers would you have to load into the ass-end of customer trucks to pay for that?” That’s when I realized that I’d end up having to recover all that money I was about to spend by loading these heavy-ass tampers into lifted-truck ends for over two weeks just to recover the costs of that gazingus pin. FUCK THAT.

Since that day, I typically view a non-security cost not in terms of the price tag, but in how many hours of work I’d have to put in to get it. Find the spending metric that means the most to you.

Another mental prod that can help turn your spending mindset into a budget-oriented one is viewing yourself and finances as its own business. No business would ever be successful unless they are in charge of their spending. This applies the same to you. See your spending as pure outflows on the books; is that spending in the best interest of the firm? If not, choose a new spending strategy, say, spending on a retirement portfolio v. that shiny,new gas-guzzling four-wheeler or that 12” tablet to match your 10” tablet, “so you can see that extra 2” of your budgeting spreadsheet”. COME ON!

If your still can’t get yourself into the right head-space, check out the following books.

Both of these are favorites of mine.

Lets get to it

Now comes the hard part, actually creating your budget. Complaining already? Relax. This is a painless and penniless process. There are loads of tools you can use, I’ll show my method, then you can transform your technique and tools to find the configurations that work best for you.

The way I see it, you’ve got two budgeting philosophies. The Zero-Sum budget or one that is percentage based (Pie Method).

Allocating certain percentages of your income to particular expense categories is the Pie Method. Imagine you have your “Income Pie” and from that your slice your income into expense categories. 20% to your Roth IRA contributions, 10% to home improvements, 30% to debts and 40% you can spend as you please. I don’t have a problem with this methodology but prefer the Zero-Sum since I can easily see straight figures and then get any percentages when I do my month-start/end reconciliation.

The Zero-Sum Budget

The Zero-Sum budget is a simple concept. At the beginning of the month, take your projected cash inflows (income) and allocate all of it to an expense category of your choosing. The crux of the Zero-Sum being that at the end of the budget session, you’ll have spent it all so that your free-cash is at $0.

Here’s an example:

| Income | $3000 |

| IRA Contribution | -600 |

| Rent | -500 |

| Home Maint. & Improvement | -300 |

| Student Loan | -300 |

| Car Savings | -250 |

| Groceries | -200 |

| Gas | -200 |

| Vacation Savings | -200 |

| Restaurants | -100 |

| Hobbies | -100 |

| Concerts | -100 |

| Clothing | -50 |

| Personal Care | -45 |

| Blog Hosting | -35 |

| Flowers for Mom | -20 |

| Left over | $(0) |

The beauty of this method is two-fold. First, during the month, all your expenses are already decided. When your friend asks if you want to go see Blue Man Group, you can go. If that concerts puts you over-budget in the concerts category, you can tell him “No, sorry, not in the budget”; nothing more to be said there. Second, you can then track and modify your expenses month over month and change your amounts and costs centers as your get a better grasp on your spending needs (notice how I said needs) .

You can also fold in these budgets into your investment plan to better determine proper expenses (just wait until you start looking at transaction fees), can look at your rent and decide if you should renew your lease or try to find a lower-cost place or even decide that you need to spend a bit more on your hobbies. The Zero-Sum budget helps keep your spending on-track and rigid, essentially providing all that tough self-discipline at the beginning of each month!

The tools

I first started budgeting with a spreadsheet, something simple that would let me easily see what-if analysis and I continue to use it. However, for my day you day I’ve found tools like Mint.com and You Need a Budget that allow for easy tracking as you can quickly apply an expense directly to a cost center, that way you can check your remaining balance for each cost center on the go. I’ve also noticed the trend of big banks releasing online-only banking apps, like Virtual Wallet that allow you to see and track your budgets and spending directly from your bank accounts. The issue with these being that they don’t hook into the rest of your accounts like Mint does.

As with everything in personal finance, the idea is not to have a perfect setup at first, but to build a budget you can fine tune to your life, expenses and investment strategy over time. Don’t worry about getting your budget correct the first month, second or even third, it will take time! Be iterative, try different categories, add and subtract others and let your budget help guide you to save for big expenses, cut costs and bring you financial peace and independence.

Let me know how this post helps you in all your financial endeavors. If you already budget, show your methods and what works for you so others can have success!

In the words of Dave Ramsey, “budgeting helps you live like no one else, so later you can LIVE like no one else.”

Sticking To the Plan

So I recently committed a cardinal sin. I shot myself in the foot and am now going to pay stupid tax. Anyone have a dunce cap I can wear?

A while back, I wrote my Investment Plan to help set a guideline for all my investment vehicle purchases, length of holdings and portfolio composition. I was, and still am, proud of how it turned out. You can take a look at it here. It has already served as a good cornerstone of my investment strategy and, up until recently, deterred me from making some stupid buys.

I fell into the trap of buying a stock because someone said it’d be a good buy. I was talking to a friend from work who has recently been on an earnings-play kick. Now, it’s important to note that playing the earnings is NOT part of my strategy but I got sucked into a “sure thing”.

We were talking about buying BioTelemetry Inc. as they were slated to release their earnings last night (Feb 19) and had beat their earnings that last 3 quarters, so of course… it had to be a sure thing.

To make matters worse, I figured I’d throw some of my Christmas bonus at the stock since “it was money I’d never planned on having in the first place”. After very limited research, I called up my broker first thing in the morning and told her I wanted to buy. She was hesitant but after my reassurance decided she’d try and buy below $11. I snagged the stock at $10.82, ecstatic since Zacks’ analysts were calling for a target price of $15 after the earnings were released.

To my dismay, BEAT did beat their revenue but didn’t make their EPS, thus the price has dropped just over 10% leaving me to pay stupid tax if I sell or try and ride this thing to break-even. What I’ll likely do is hang onto this and see what the next quarter brings since I do feel bullish about the stock and am optimistic about what the firm is doing with their products and services.

The point however, is that I loosened my self-control, got hooked into a “sure thing” and deviated from my strategy. Letting your emotions dictate what stocks you’re going to buy typically lends itself to heartache, as I don’t believe a single investor will ever beat the market over the long-term.

I’m somewhat disappointed in myself, take full responsibility for my actions and am going to use this as a learning experience. I’m still hopeful to make a return on this but now I’ve got to hang onto this stock for a longer period of time than I’d anticipated and broke a promise to myself NOT to deviate from my strategy.

LESSON LEARNED

Lessons learned from outages

Due to call the coding I’ve been doing lately, I haven’t had the most time to write and update this blog.

I’ve been working primarily with Codecademy.com and a number of other online resources to lock in my HTML, CSS and Javascript skills so that I can begin to develop some websites to take some of my business ideas to the next level.

So, aside from coding in my free time, I’ve also been very busy at work dealing with an elevated number of system outages we’ve seen in our server environment lately. These outages are the subject of this blog post today.

Recently we’ve seen outages in our Cisco UCS environment nearly weekly, causing production outages that have persisted for an average of five to six hours at a time.

Being a young engineer in the server environment, these outages have been my first exposure to what a massive outage can mean to a business. These outages have helped to shed even further light on the need for the business to have a STABLE server environment as customers and the business ultimately rely on these servers to keep their day-to-day functions running without issue.

While these outages are negative events, they’ve served the positive function of allowing me to enhance my technical skills and to learn even more about how upper management deals with an outage by interfacing with vendors and the operational teams tasked with keeping the systems online.

Seeing the upper management deal with these outages has opened my eyes to what makes a manager good and bad at working with a critical outage. We typically open up telephone bridges that have one to four upper level managers on the line and simply by listening in to these conversations I’ve been able to take mental notes of the big ticket items a manager focuses on during an outage and the problems that caused the outage to begin with.

Some of the take-aways I’ve seen have been that being calm during an outage is one of the most valuable traits a manager can have. While the manager may not know the technical details of the outage he should understand how that system directly interfaces with the services they are used to support. The valuable calmness on a bridge often does come from the managers who understand the true business impact and the ways that they can get the systems back online in a timely manner. This has recently been shown with one of the largest outages we faced where the manager was able to focus on the number of operations resources we might need if and when the system came online to get the servers back online.

Prior to hearing that comment, my managerial mindset hadn’t even considered that, but realizing that the resources we currently had on hand wouldn’t be able to get the servers online in a timely manner.

The best managers have also been able to apply the appropriate amount of pressure the vendors (in highly professional ways) so that they would recognize how important it is to our company that the vendor solve the flaws in their firmware and software code to be sure the outages don’t happen again.

I image as time progresses and I continue to troubleshoot and support more system outages I will be able to gain even more management knowledge to ensure these don’t happen again. My goal is to take these learning with me to my own ventures and to my management career! While the outages are terrible, the lessons I take from them are second to none.